For decades, Vietnam has faced a peculiar corporate governance issue that locals call "buông rèm nhiếp chính" (ruling from behind the curtain) – where the real decision-makers hide behind legal proxies. Think of it as corporate puppetry, where:

- The puppets are legal owners and directors on paper

- The puppeteers are the true decision-makers and beneficiaries

- The strings are invisible contractual arrangements and relationships

This isn't just academic theory – it's a tangible problem with real-world consequences. The Van Thinh Phat case provided a stark illustration: a sprawling ecosystem of seemingly unrelated companies that appeared legally distinct but were actually controlled by the same hidden hands. Those who signed the documents were mere "front men," while actual power resided elsewhere.

Looking further back, the Epco Minh Phung case of the late 1990s followed a similar pattern: numerous individuals standing in as nominal owners while the real puppetmaster pulled strings from the shadows.

Why Hide Behind the Curtain? 🎭

A fascinating question emerges: why would someone let others legally own assets worth hundreds of billions of dong that actually belong to them? While comprehensive data is lacking, logic suggests two primary motivations:

- Avoiding scrutiny from the public and regulatory authorities

- Evading legal responsibility, especially criminal liability, when companies violate the law

This practice creates a shadowy parallel economy. According to the Vietnam Chamber of Commerce and Industry (VCCI), Vietnam has over 800,000 businesses, mostly small and medium enterprises, many family-owned with opaque structures that mask their true controllers.

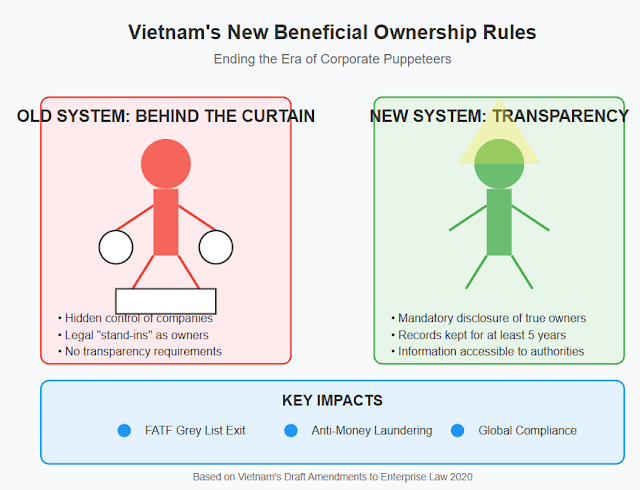

Enter the Beneficial Owner: Vietnam's Game-Changer 🎯

The draft law defines a "beneficial owner" in Article 4, Paragraph 23 as:

"An individual, organization, or group capable of controlling a business through ownership, acquisition of shares, capital contributions, or making decisions for the company."

This seemingly simple definition takes direct aim at the shadow controllers who have historically operated without accountability. The key phrase "making decisions for the company" targets stand-ins who act as fronts for hidden owners.

The amendment introduces three critical requirements:

- Disclosure of information: Companies must report beneficial owners when established or within 10 days of any changes

- Information storage: Data must be kept at both the business and registration agency for at least five years after the company ceases operations

- Information declaration: Representatives must accurately declare companies they or related persons control

Could Puppeteers Find New Strings? 🕸️

Can the law be circumvented? Perhaps. For instance, someone could have a proxy hold controlling shares, then legally authorize voting rights to themselves. On paper, this appears legitimate. However, if beneficial ownership information is properly tracked and recorded, this proxy arrangement can't completely hide the true role.

Another scenario: shadow controllers might use complex ownership structures through multiple layers of foreign companies. Yet, with centralized data systems and international cooperation (as required by FATF), such "fronts" will gradually lose effectiveness as authorities gain better monitoring tools.

Real-World Example: The Maze of Corporate Control 🏢

Consider "Sunlight Group," a Vietnamese real estate developer. On paper, it appears to be owned by five separate entities, each holding 20% shares. Publicly, these five entities have different addresses, different management teams, and seem unrelated.

But behind the scenes:

- All five entities were established with capital from the same source

- Key decisions across all five are made by the same individual, "Mr. X"

- Mr. X himself holds no shares or titles in any of these companies

- All profits ultimately flow back to Mr. X through complex arrangements

Under the current system, this structure is technically legal and largely untraceable. Under the new beneficial ownership rules, Mr. X would need to be disclosed as the beneficial owner of the entire operation, regardless of his lack of formal titles or shareholdings.

Did You Know? 🤔🤔

- The concept of beneficial ownership has existed in UK law since the 2006 Companies Act through the notion of "shadow directors" - persons who direct company activities without formal appointments

- The Financial Action Task Force (FATF) placed Vietnam on its "Grey List" in June 2023 for financial transparency deficiencies, with a deadline to comply by May 2025

- Without these reforms, Vietnam risks seeing its impressive $36.6 billion in foreign direct investment (2023) decline as international transactions face greater scrutiny

- A World Bank report (October 2024) ranked Vietnam's market entry index low (29/50) partly due to lack of ownership transparency

The Impact: Ripples Through Vietnam's Business Landscape 🌊

If passed, these regulations will create significant waves of change:

1. Corporate Restructuring 🏗️

Family businesses using relatives as fronts will need to disclose who truly holds power. A property developer in Ho Chi Minh City using cousins as "shields" would have to declare who actually controls operations. They might try to find loopholes, but even small changes in "hiding" habits would be progress.

Long-term, this promotes digital governance: information must be stored electronically, forcing businesses to invest in technology and catch up with global trends like Singapore's fully digitized business registration system.

2. International Compliance 🌎

This is Vietnam's opportunity to exit FATF's "Grey List," avoiding consequences like reduced FDI or restricted financial transactions. The amendment would improve Vietnam's competitive standing against ASEAN neighbors like Thailand, where transparency frameworks have long been established.

3. Financial Crime Prevention 👮♀️

With beneficial ownership data, investigators can more easily trace money laundering and tax evasion. "Ghost companies" - estimated to number in the thousands among Vietnam's 800,000 registered businesses - and phantom capital will be curtailed, protecting legitimate enterprises. Had these regulations been in place earlier, the Van Thinh Phat case might have been detected sooner through transparent information about shadow controllers.

Nature's Lesson: No Hidden Control in Natural Systems 🌿

Interestingly, nature offers few examples of true "hidden control." In biological systems, the entity exerting control is typically visible and identifiable. Ant colonies have clear queens, wolf packs have observable alphas, and even parasites that manipulate host behavior are physically present, though sometimes microscopic.

This contrasts sharply with human corporate structures that allow complete separation between control and visibility. Perhaps there's evolutionary wisdom in nature's transparency – systems where cause and effect are disconnected tend to be unstable and vulnerable to exploitation.

Vietnam's move toward beneficial ownership regulation is, in many ways, aligning corporate governance more closely with natural systems, where the entity exercising control must be identifiable and accountable. 🐜👑

Test Your Knowledge! 📝

- What is the Vietnamese term for controlling companies from behind the scenes?

- When did FATF place Vietnam on its "Grey List"?

- How long must beneficial ownership information be stored after a company ceases operations?

- What case provided a stark example of hidden corporate control in recent years?

- What are the two main reasons people create front companies with hidden ownership?

(Answers at the end of this post!)

Tips for Navigating the New Rules 💡

For business owners:

- Audit your structures: Review any nominee arrangements now before disclosure becomes mandatory

- Prepare documentation: Identify all individuals who meet beneficial ownership criteria

- Consider legitimate restructuring: If privacy concerns are legitimate, consult with experts on compliant alternatives

- Update company policies: Create procedures for tracking and reporting beneficial ownership changes

- Train representatives: Ensure those filing company documents understand the new requirements

For investors:

- Enhanced due diligence: Ask more questions about ownership structures before investing

- Look for transparency: Companies willingly disclosing beneficial ownership signal better governance

- Watch for red flags: Complex structures without clear business purpose may indicate problems

- Prioritize compliance: Businesses with solid compliance systems reduce your risk exposure

A New Dawn for Corporate Transparency 🌅

Vietnam's move to regulate beneficial ownership represents a significant advancement in its corporate governance journey. It addresses both international standards and domestic challenges, establishing a foundation for sustainable economic growth.

For this to succeed, businesses must adapt, government must provide detailed guidance, and society must maintain vigilance. While the effectiveness of these regulations will take time to evaluate, the mere fact that Vietnam is confronting this issue marks substantial progress toward transparency in corporate governance.

We Want to Hear From You! 🗣️

Do you think Vietnam's new beneficial ownership regulations will effectively end the era of "puppeteer ownership"? What challenges do you foresee in implementation? Are there additional measures you believe would strengthen corporate transparency? Share your thoughts in the comments below!

Quiz Answers:

- "Buông rèm nhiếp chính" (ruling from behind the curtain)

- June 2023

- At least five years

- The Van Thinh Phat case

- Avoiding scrutiny and evading legal responsibility

Keywords: #BeneficialOwnership #VietnamCorporateGovernance #EnterpriseLaw #TransparencyRegulations #BusinessCompliance #ShadowDirectors #CorporateGovernance #VietnamLegalReform #FATFCompliance #AntiMoneyLaundering

Hey there, corporate governance explorer! 🕵️♂️ Before you go...

- This article is like a transparency map, not a compliance guarantee 🗺️ It'll help you understand the landscape, but won't automatically make your structures compliant!

- Each business structure has unique considerations 🦄 Your specific situation may require tailored analysis!

- For professional guidance on beneficial ownership compliance, consult a qualified corporate lawyer 🧙♂️ (May we suggest Thay Diep & Associates Law Firm?)

Remember: Reading about beneficial ownership rules doesn't make you a compliance expert, just like watching "The Wolf of Wall Street" doesn't make you a finance guru! 💼😉

#LegalInfo #NotLegalAdvice #ConsultAPro

Enjoyed Ngọc Prinny's witty corporate governance insights? Help keep this ninja caffeinated! Every article is powered by:

- Hours of research into Vietnam's evolving legal landscape 📚

- Legal expertise spanning 10+ years ⚖️

- Creative storytelling that makes complex regulations digestible 📝

- And lots of coffee! ☕

If my posts have helped you navigate Vietnam's corporate governance labyrinth, consider treating me to a coffee! Your support helps keep the legal insights flowing and the governance knowledge growing. 🌱

Warm Wishes For You 💫

If you're reading this article in the evening, I wish you peaceful dreams free of corporate compliance concerns and shadow directors! May your sleep be as transparent as the new beneficial ownership rules aim to be! 🌙✨

If you're reading this article in the morning, may your day be filled with ethical business practices and clear corporate structures that would make any regulator proud! ☀️📈

If you're a business owner reviewing your corporate structure, may you find the perfect balance between legitimate privacy and necessary transparency that serves both your interests and the integrity of Vietnam's business environment! 🏢🔍

If you're a legal professional helping clients navigate these changes, may your guidance be both compliant and creative, showing the path to success within the bounds of the new regulations! ⚖️💡

And whatever your connection to Vietnam's business world, remember: A transparent system benefits all legitimate participants in the long run. Wishing you success and integrity in all your ventures! 🌈✨

Spill the Beans, Spread the Love, & Brighten My Day! ☕️⚖️🌟

- Local Support (VND): Local Bank QR Code:📱

- International Support (USD via PayPal): 💸 PayPal: @NgocPrinny

.jpeg)